Doing your daily tasks online simplifies your life and helps you get organised. Go paperless and get your statements and advices online for more convenience.

More reasons to go paperless. Tap on or mouse over to learn more about the benefits.

Convenience

View up to 7 years of your E-Statements and/or up to 2 years of your E-Advices on Citibank Online.

Notification

You will receive a notification when your E-Statement or E-Advice is ready to be viewed on Citibank Online. You can also set up SMS reminders for your Citibank Credit Card and Ready Credit payment due dates.

Each E-Statement or E-Advice sent to your email is password protected. You can also view your E-Statement or E-Advice on Citibank Online using your user ID and password.

Every E-Statement and E-Advice counts towards reducing paper usage. You may still print or save your E-Statements and E-Advices if needed.

How To ApplyWe appreciate your support in going green. Here's how to enroll for E-Statements and E-Advices.

We will notify you by email or SMS once you have successfully enrolled for E-Statements and/or E-Advices. You will receive E-Statements from your next statement onwards; and E-Advices within the next 24 hours.

Important note:

It is important to keep your contact information updated with us as we may need to get in touch with you on important matters relating to your account. If you are enrolled for E-Statements and/or E-Advices, a message containing instructions to access your E-Statement and/or E-Advice will be sent to your registered email address or mobile number.

You can now view your e-Statements securely on your mobile phone. Download the

Citi Mobile ® App and view your e-Statements in 3 easy steps now.

Receive push notifications when there are activities or updates on your Citi Credit Card/Ready Credit Card: transactions, payment due, payment received, 95% of Credit Line Reached and more.

For a full list of alerts you can receive via push notifications on your Citi Mobile ® App and other FAQs, click here.

Download Citi Mobile ® App, your card companion app:

OR

OR

Click here to login to Citibank Online and view your E-Statements.

If you are already logged into Citibank Online:

Select from the "Quick Tasks" section on the right panel.

Select the statement, year and month.

Click on the confirmation page to download or view the statement.

For E-Statements or E-Advices sent to you by email, click here to view or edit your settings. Please note that PDF copies of the E-Statements or E-Advices that are sent by email will be password protected. You are strongly advised to change your default password as soon as possible.

Click here to login to Citibank Online and view your E-Advices.

Click here to view list of electronic and paper advices.

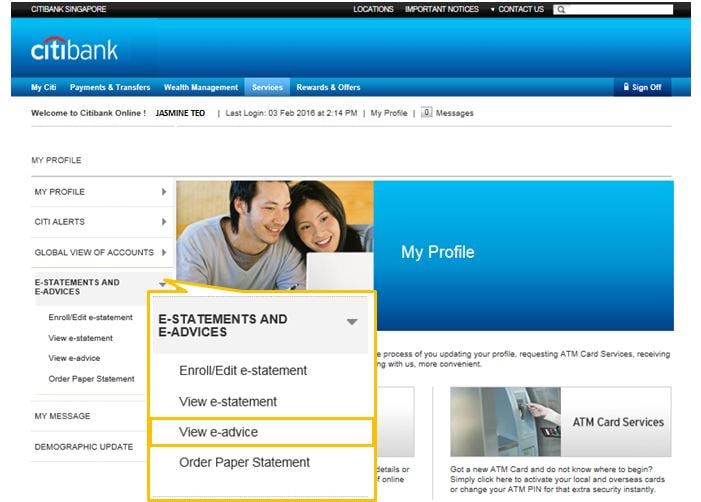

If you are already logged into Citibank Online :

Click , and select the advice type and advice period.

Click on the confirmation page to download or view the advice.

For E-Statements or E-Advices sent to you by email, click here to view or edit your settings. Please note that PDF copies of the E-Statements or E-Advices that are sent by email will be password protected. You are strongly advised to change your default password as soon as possible.

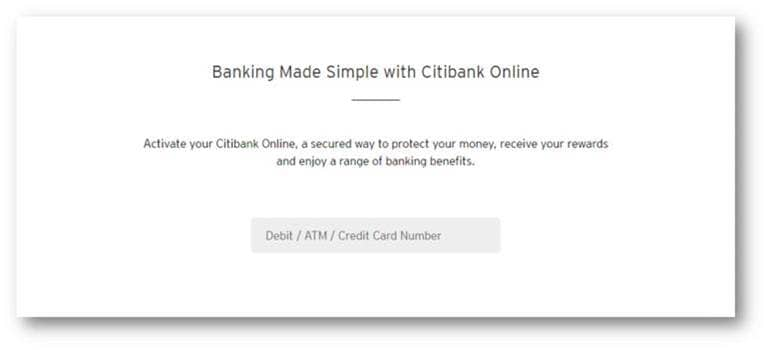

Register now. All you need is your card or account details and mobile phone number (registered with Citibank).

Security tip:

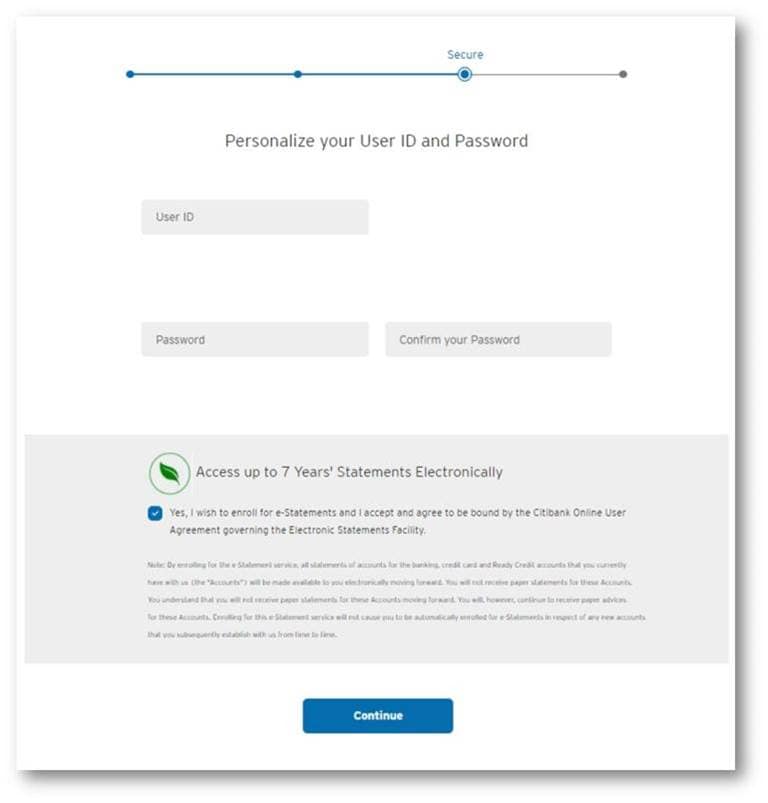

Ensure your preferred User ID and password meets security requirements of length and complexity.

Get more benefits with Citibank Online: Not only will you be able to view E-Statements/E-Advices, you'll find that doing everything else, from payments and transfers, to overseas card activation and monitoring your investment, can be so much easier. Find out more.

Click on  to expand and on

to expand and on  to minimise the details.

to minimise the details.

Citi recommends that you access your statements and advices via Citibank Online and/or the Citi Mobile ® App, as your statements accessed via these platforms are protected by two-factor authentication of UserID/Password and One-time PIN. For statements sent via physical mail, there may be the risk of your confidential information being viewed by others who open your physical mail without permission.

Also, up to 7 years of your statements and advices can be accessed anytime, anywhere on Citibank Online and/or the Citi Mobile ® App, even when you are overseas.

Once you are enrolled to e-Statements/e-Advices, you will receive an email notification from us whenever you have statements/advices ready for viewing. Click here to login to Citibank Online to enroll now.

For statements that are sent to your email inbox, an e-Statement password is required to view your statements. Citi recommends that you regularly change your password. Click here to login to Citibank Online to access your e-Statement/e-Advice settings and set a new password.

However, for added security, we recommend to view your statements online, by accessing your statements from Citibank Online and/or the Citi Mobile ® App, where your statements are protected by two-factor authentication of UserID/password and One-time PIN.

Upon successful enrollment, your next statement will be an e-Statement; and you will be activated for e-Advices within 24 hours. You will receive an email or SMS to inform you that your e-Statement or e-Advice is ready for viewing.

You will receive an email notification for each of your accounts whenever your e-Statements are ready for viewing. If you do not have an email address, an SMS notification will be sent to your registered mobile number whenever your e-Statements are ready for viewing.

Yes, you will be able to view up to 7 years of your previous statements and up to 12 months of your previous advices on Citibank Online regardless of when you are enrolled.

You can save or print a copy of your e-Statement and/or e-Advice by clicking on the 'save' icon or 'print' icon on the top navigation bar of the Adobe or PDF reader software.

No, you will not receive any paper statements if you are enrolled for Citibank e-Statements.

If you have not changed your default password, you may SMS 'STMTPASSWORD' to 72484 to receive an SMS on your default password.

Alternatively, click here to login to Citibank Online to access your e-Statement/e-Advice settings and set a new password.

Yes, you can amend your e-Statements set up. Click here to login to Citibank Online to access your e-Statement settings and uncheck the option of receiving statements as an email attachment. Your subsequent e-Statement notifications via email will no longer include your e-Statement as an attachment.

If you are receiving your e-Statement/e-Advice email notification without a PDF attachment but still prefer to receive these as PDF attachments, click here to login to Citibank Online and select the option of receiving statements and advices as PDF attachments in your email.

Upon successful enrollment, your next statement will be an E-Statement; and you will be activated for E-Advices within 24 hours.You will receive an email or SMS to inform you that your E-Statement or E-Advice is ready for viewing.

You may enroll yourself to a “7 days Payment Due Reminder” alert. Click here to login to Citibank Online to access CitiAlerts settings. Once you are logged into Citibank Online:

Click here to find out more about other CitiAlerts and reminders

For added security, you are advised to change your default password immediately. Click here to login to Citibank Online to access your e-Statement and e-Advice settings and set a new password.

Any change in password will only affect e-Statements received after such change. Should you wish to view past e-Statement(s), you will be required to use the password that was active at the time of receipt of such e-Statement(s).

Alternatively, instead of accessing your past emails, you can always log in to Citibank Online to view your previous e-Statements and e-Advices, where you will be authenticated with your UserID/Password instead of your e-Statement password.

Any change in password will only affect statements received after such change. Should you wish to view past statement(s), you will be required to use the password that was active at the time of receipt of such statement(s).

You may enroll for e-Statements, but you will receive your e-Statements only if the main cardholder is also enrolled for e-Statements.

Your statement arrangement will follow that of the main account holder.

I.e. If the main account holder is on e-Statements, he/she will receive the statements in his/her email inbox and will be able to view the statements via Citibank Online. The secondary account holder will not receive the statements in his/her inbox but will be able to view his/her statements via Citibank Online regardless if he/she is on e-Statements. Likewise, if the main account holder is on paper while the secondary account holder is on e-Statements, a paper statement will be sent.

Yes. You can choose to enroll for e-Statements for either your banking accounts only, credit card accounts only or both.

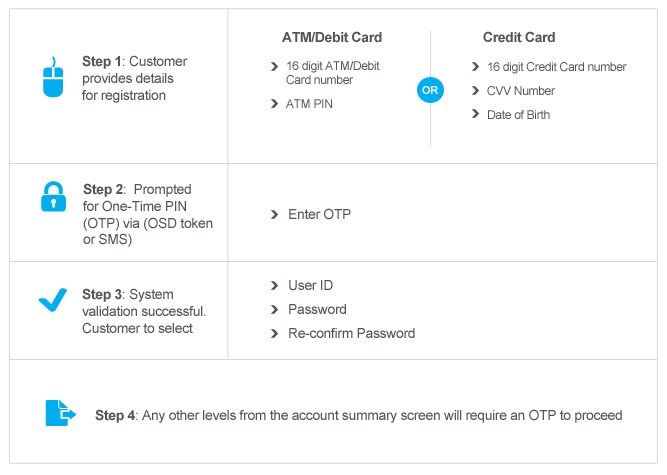

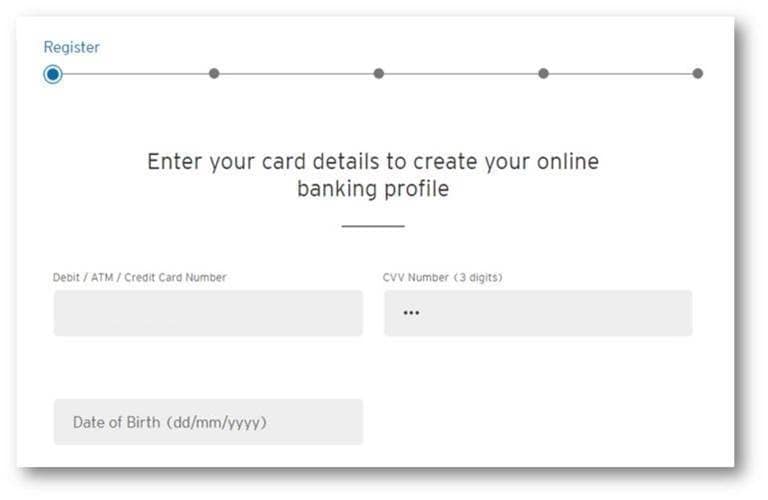

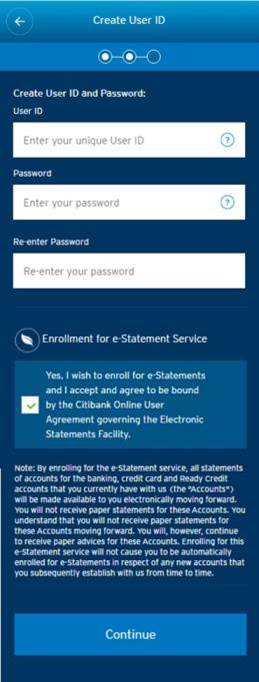

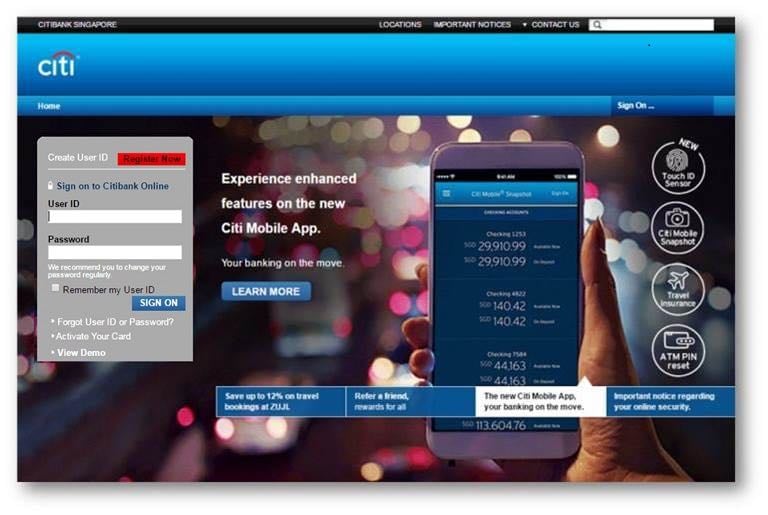

Please follow these steps to register for online banking account:

Click on "Register Now"

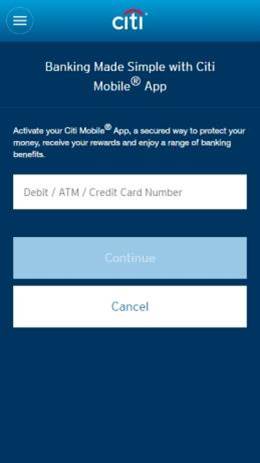

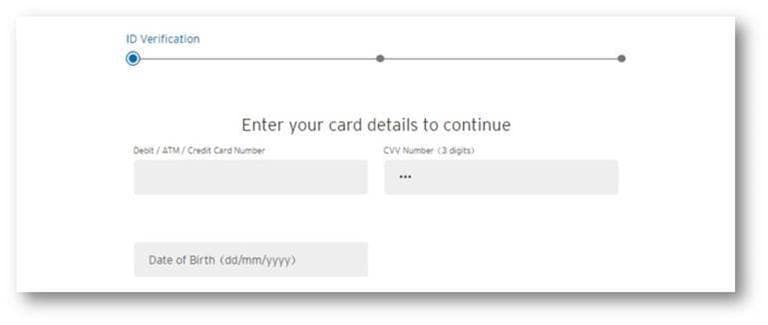

Step 1: Enter any of your Debit / ATM / Credit Card Number

For Credit Card enter CVV and your Date of Birth.

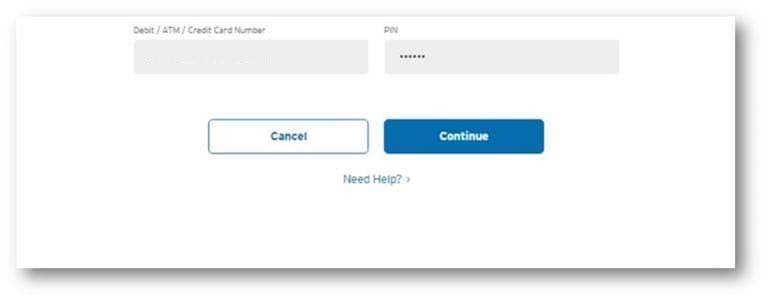

OR, for Debit / ATM Card, enter your Card PIN.

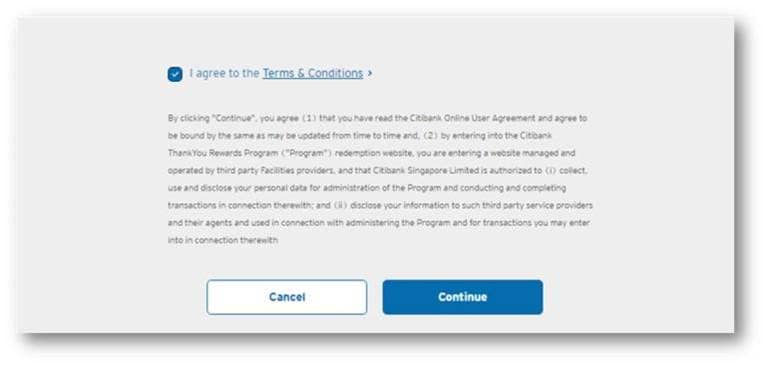

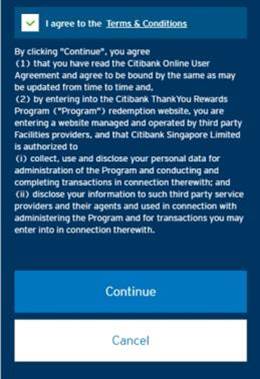

Read the Terms & Conditions from the link and click "I agree" checkbox. Click "Continue" to proceed.

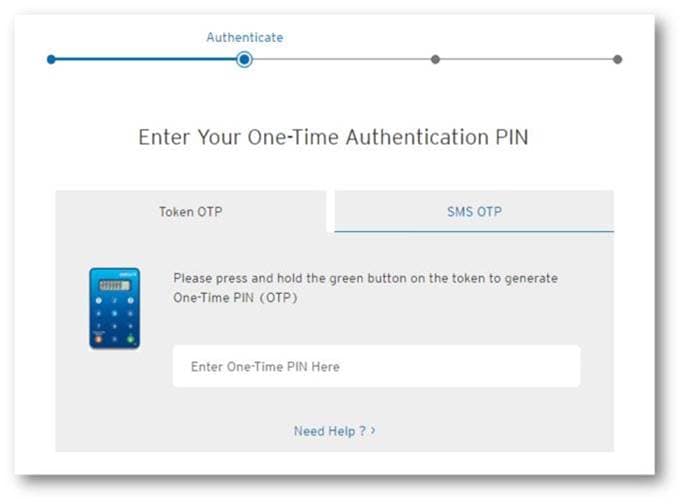

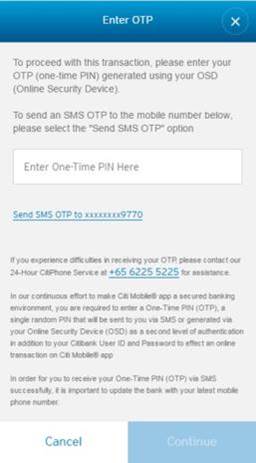

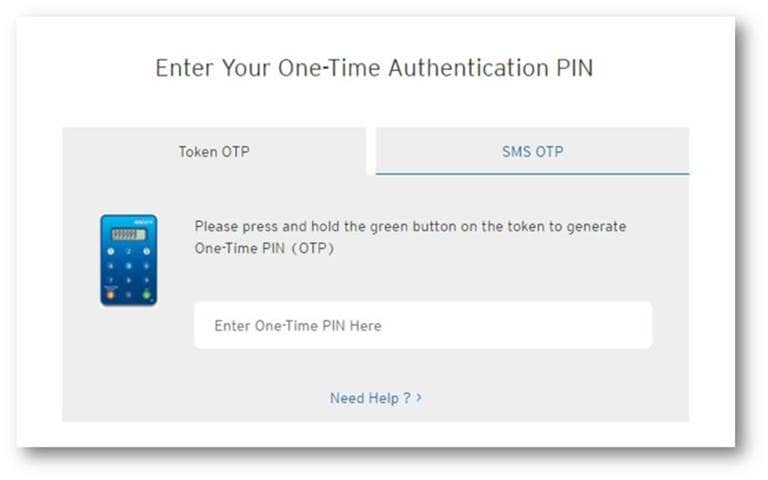

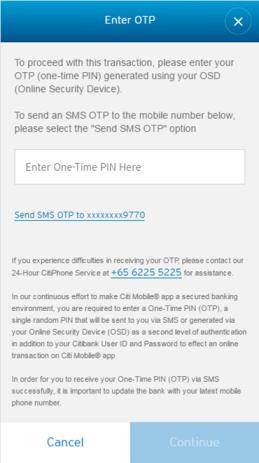

Step 2: Enter One-Time PIN (OTP) to proceed

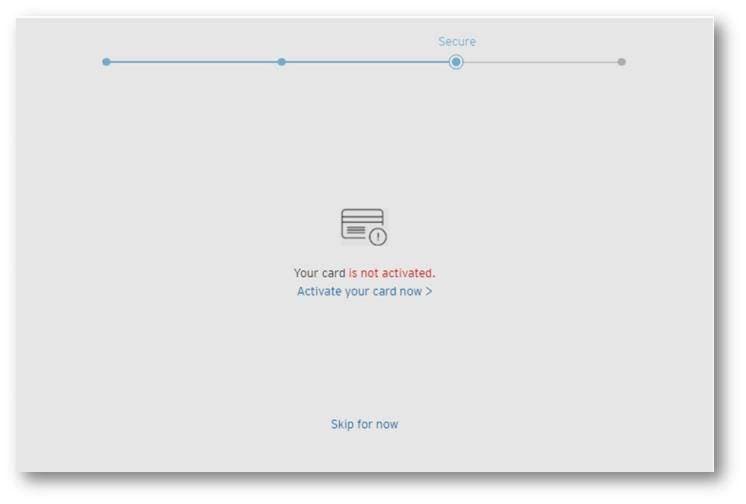

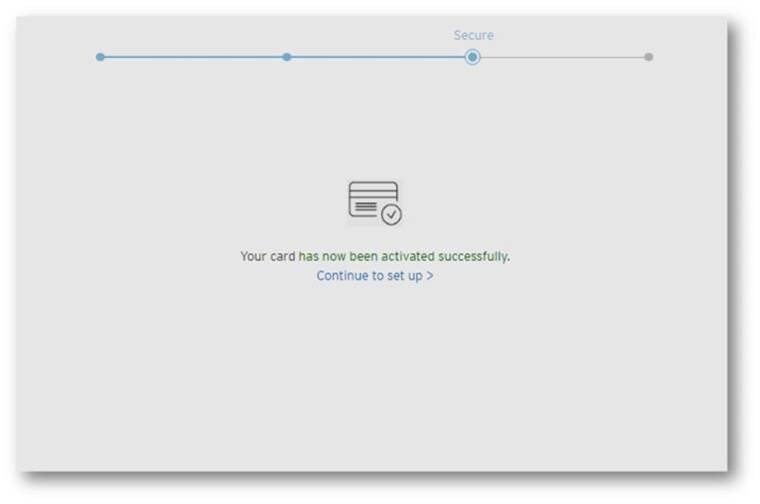

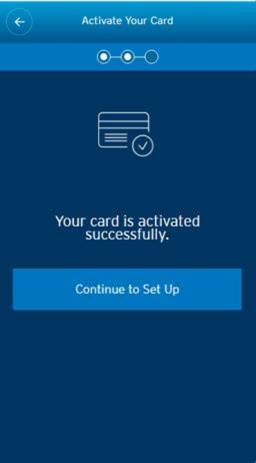

Step 3: Click on "Activate your card now". If your card is already active, please skip to the next step.

Click "Continue to set up" to proceed.

Enter your preferred User ID and Password

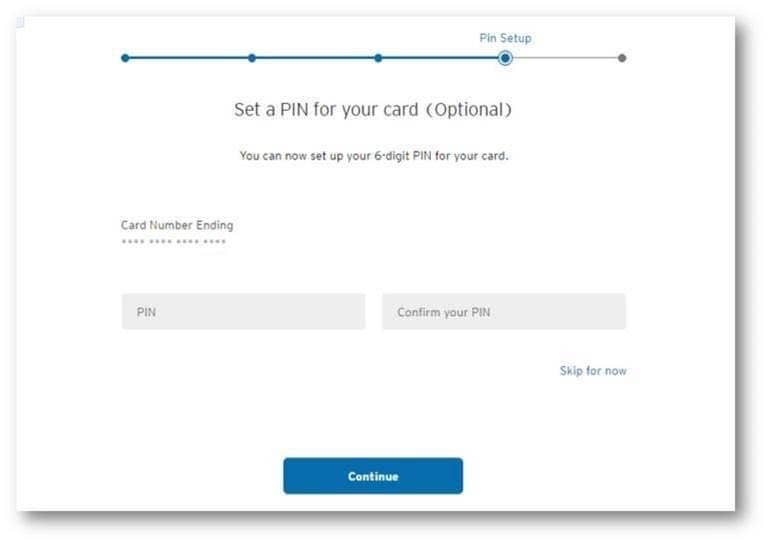

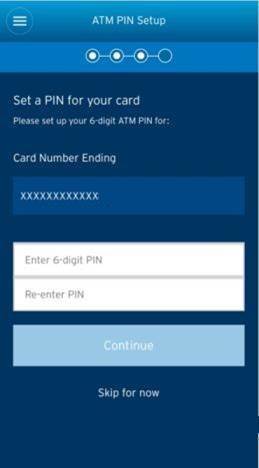

Step 4: Enter your preferred 6-digit PIN for your card (Optional). Click "Continue" to proceed.

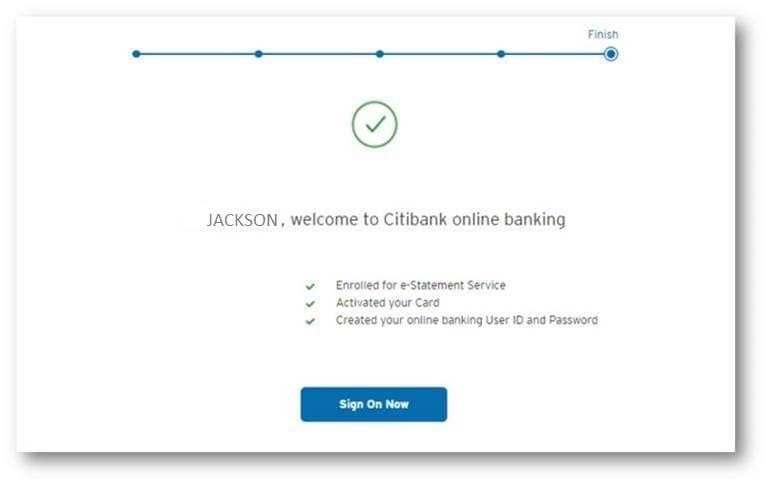

Step 5: Registration Completed

Click on "Register"

Step 1: Enter any of your Debit / ATM / Credit Card Number

For Credit Card, enter CVV and your Date of Birth.

OR, for Debit / ATM Card, enter your Card PIN.

Read the Terms & Conditions from the link and click "I agree" checkbox. Click "Continue" to proceed.

Enter One-Time PIN (OTP) and Click "Continue" to proceed

Step 2: Click on "Activate Your Card". If your card is already active, please skip to the next step.

Click "Continue to Set Up" to proceed.

Enter your preferred User ID and Password

Step 3: Enter your preferred 6-digit PIN for your card (Optional). Click "Continue" to proceed.

Step 4: Registration Completed

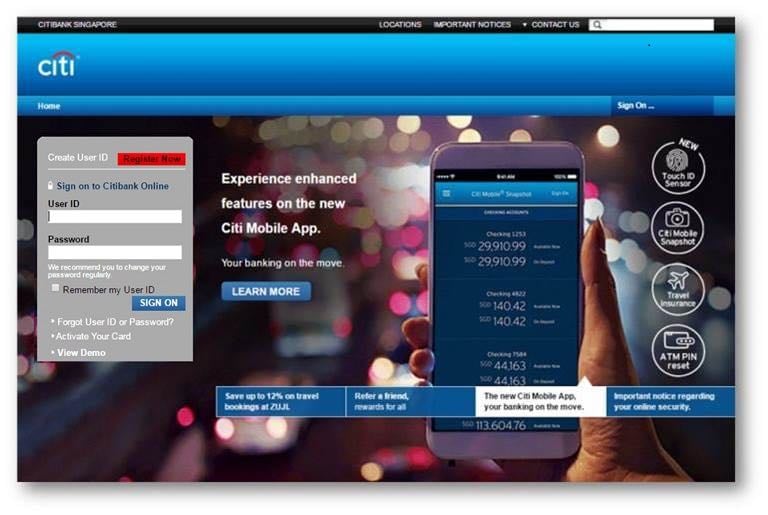

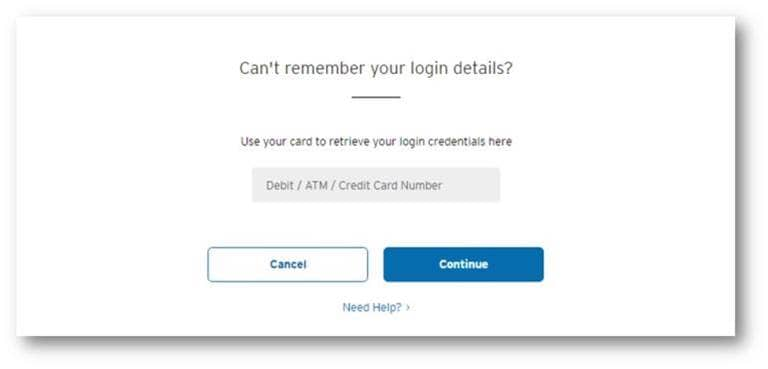

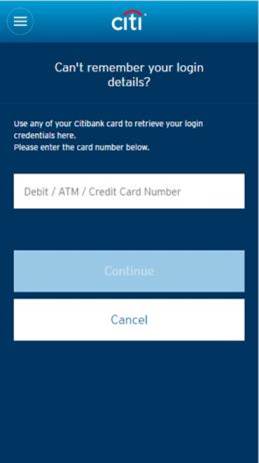

Click on "Forgot User ID or Password"

Step 1: Enter any of your Debit / ATM / Credit Card Number

For Credit Card, enter CVV and your Date of Birth. Click "Continue" to proceed.

OR, for Debit / ATM Card, enter your Card PIN. Click "Continue" to proceed.

Step 2: Enter One-Time PIN (OTP) to proceed

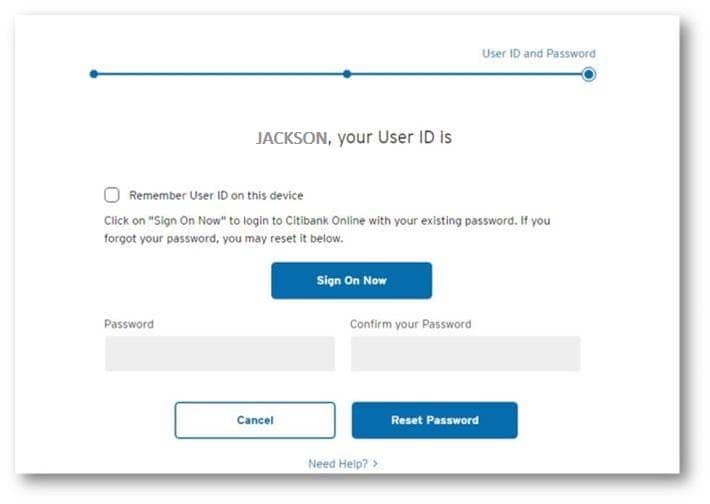

Step 3: Your User ID is shown on the screen. Click on "Sign On Now" to login to online banking with your existing password. If you forgot your password, you may reset it below.

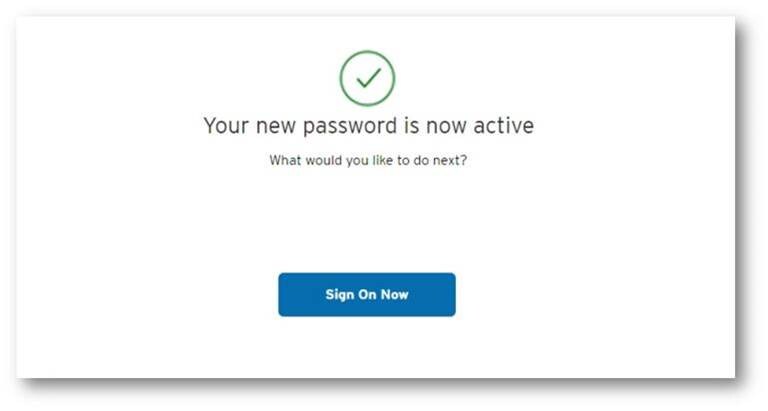

Step 4: Password reset completed. Click on "Sign On Now" to manage online banking account.

Click on "Forgot User ID or Password"

Step 1: Enter any of your Debit / ATM / Credit Card Number

For Credit Card, enter CVV and your Date of Birth. Click "Continue" to proceed.

OR, for Debit / ATM Card, enter your Card PIN. Click "Continue" to proceed.

Enter One-Time PIN (OTP) and Click "Continue" to proceed

Step 2: Your User ID is shown on the screen. Click on "Sign On Now' to login to online banking with your existing password. If you forgot your password, you may reset it below.

Step 3: Password reset completed. Click on "Sign On Now" to manage online banking account.

Citi recommends that you access your statements and advices via Citibank Online and/or the Citi Mobile ® App, as your statements accessed by these platforms are protected by two-factor authentication of UserID/Password and One-time PIN. For statements sent via physical mail, there may be the risk of your confidential information being viewed by others who open your physical mail without permission.

Also, up to 7 years of your statements and advices can be accessed anytime, anywhere on Citibank Online and/or the Citi Mobile ® App, even when you are overseas.

If you still prefer to receive your statements and/or advices by mail, please follow the steps below.

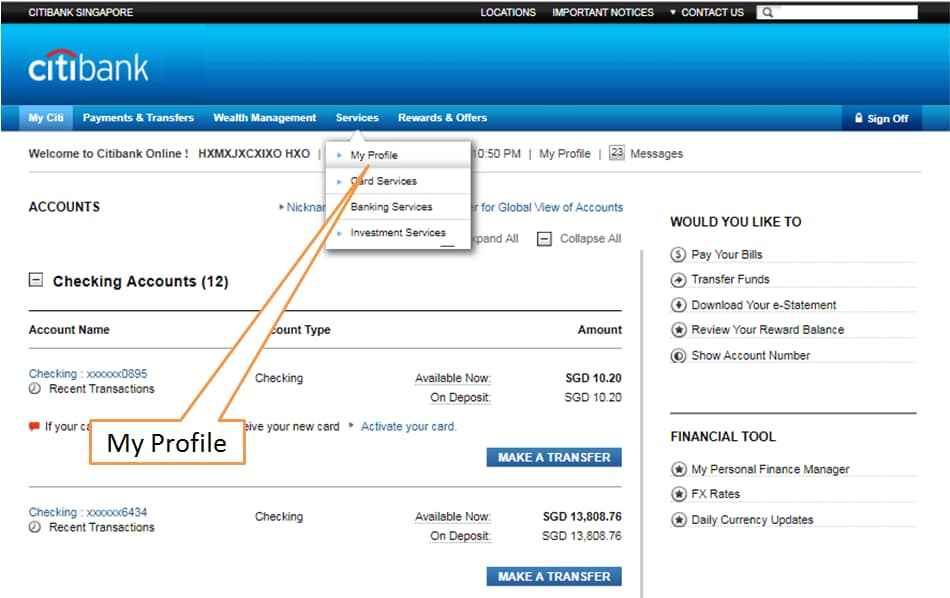

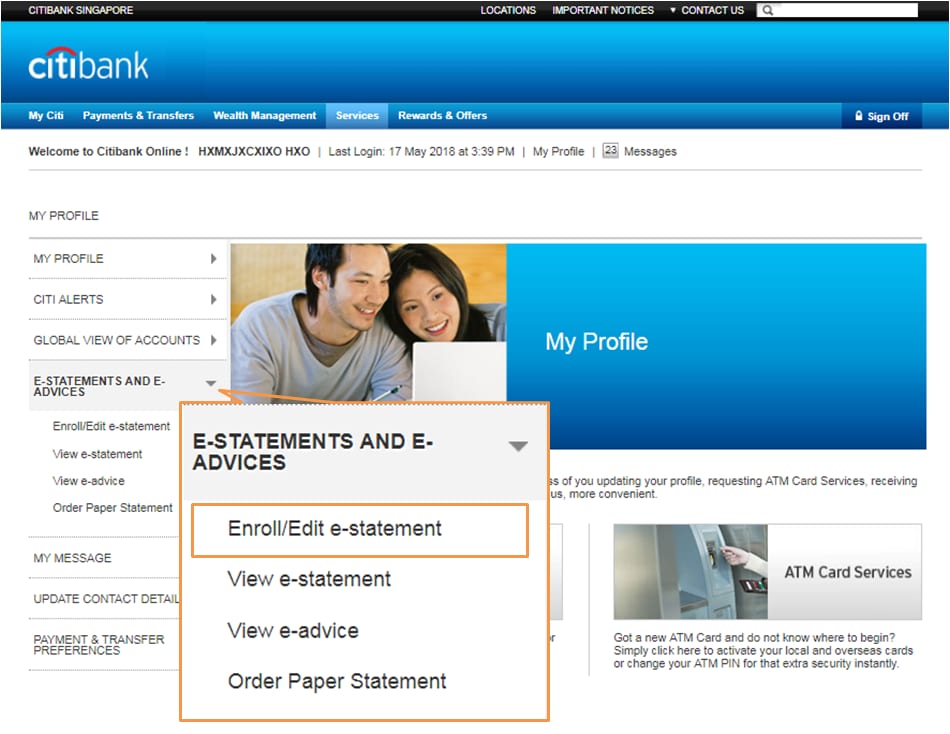

Login to Citibank Online and select .

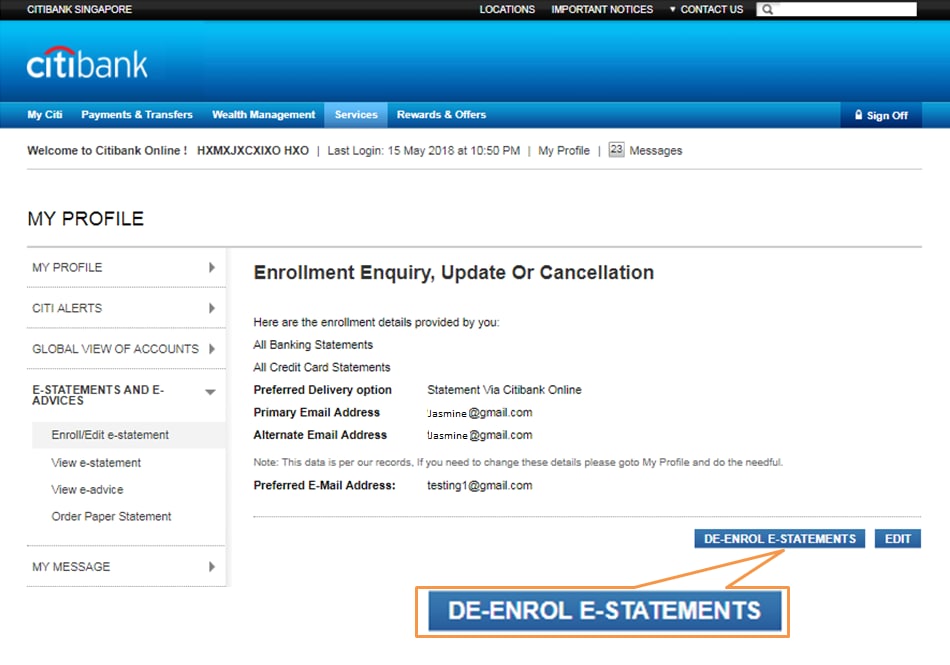

Click on and follow the confirmation steps to de-enroll from e-Statements.

If you prefer to receive paper statements and advices rather than electronic versions, please login to Citibank Online and select , , and click .

Important Notes:Important Notes:

Customers who hold banking, investment, secured loan, Credit Card and Ready Credit accounts will be eligible for E-Statements.

Customers who hold banking, investment, secured loan accounts will be eligible for E-Advices.

For regulatory and security purposes, some advices will continue to be sent via mail. For a full list of electronic and paper advices, please click here.